Learn the main rules you need to know before you report a foreign gift

Whatever You Need to Learn About Reporting a Foreign Present: A Comprehensive Overview

Reporting international presents is an essential aspect for U.S. establishments. Comprehending the lawful requirements and the ramifications of non-compliance is crucial for maintaining stability. Institutions have to browse complex reporting limits and target dates. Correct documents plays a crucial function in this process. As the landscape of worldwide contributions develops, establishments should adjust their practices appropriately. What are the very best methods to assure compliance and transparency?

Comprehending Foreign Gifts: Meaning and Extent

While several institutions may receive different types of support, understanding foreign presents calls for a clear meaning and extent. Foreign presents describe any kind of materials, funds, or services given by international entities, people, or federal governments to united state establishments. These presents can come in different types, including cash payments, property, research study funding, and scholarships.

The range of foreign gifts incorporates not just straight financial backing however also in-kind payments that may influence the organization's operations or study top priorities. It is essential for establishments to acknowledge the implications of accepting such presents, as they may carry specific conditions or expectations from the donor. Understanding the nuances of international gifts aids organizations in keeping openness and responsibility while fostering international relationships. Inevitably, a comprehensive understanding of international presents is important for organizations to browse the complexities of financing and maintain their stability in the academic and study neighborhood.

Lawful Demands for Coverage Foreign Gifts

Furthermore, government laws might necessitate transparency pertaining to the resources of funding, particularly if connected to delicate study locations. Institutions need to keep exact documents of foreign gifts, ensuring they can corroborate reported payments throughout audits. This procedure commonly calls for cooperation among different institutional divisions, consisting of finance, legal, and compliance teams, to assure adherence to both institutional plans and federal standards. Comprehending these lawful frameworks is vital for establishments to effectively manage and report foreign presents.

Trick Reporting Thresholds and Deadlines

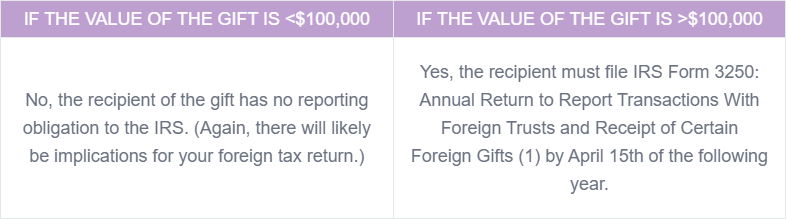

Organizations need to understand details reporting due dates and limits to validate conformity with laws concerning foreign gifts. The U.S. Division of Education requires institutions to report any type of international presents surpassing $250,000 within a fiscal year. This threshold incorporates both specific gifts and advancing payments from a solitary foreign resource.

Furthermore, institutions need to report any type of foreign gifts surpassing $100,000 to the Foreign Agents Registration Act (FARA) if the presents are connected to lobbying or political tasks.

Due dates for reporting are vital; institutions are usually called for to send yearly records by July 31 for gifts gotten during the previous . Failing to satisfy these thresholds or deadlines might bring about penalties, consisting of loss of government funding. Consequently, establishments must develop an attentive surveillance and reporting procedure to guarantee adherence to these essential laws.

Just How to Effectively Record and Record Foreign Present

Correct paperwork and coverage of international presents call for a clear understanding of the essential compliance actions. This includes adhering to a needed documentation list and adhering to recognized reporting procedures. Lawful factors to consider need to additionally be taken into consideration to assure full conformity with suitable regulations.

Needed Paperwork List

When reporting foreign gifts to determine compliance with regulative requirements, accurate documents is important. Organizations need to keep a detailed record of each present, consisting of the donor's name, the quantity or value of the present, and the date it was obtained. Furthermore, a summary of the objective of the present and any kind of restrictions enforced by the benefactor needs to be recorded. Communication with the benefactor, such as emails or letters, can offer context and confirmation. It is additionally important to consist of any relevant contracts or agreements. Financial records, such as bank statements or receipts, need to sustain the worth of the gift. Appropriate organization and retention of these records will promote the coverage procedure and assurance adherence to guidelines.

Reporting Procedures Summary

When maneuvering the intricacies of reporting foreign presents, it is necessary to comply with recognized procedures to assure compliance with regulative requirements. Organizations must begin by identifying the nature and value of the gift, ensuring accurate documents. This consists of assembling receipts, benefactor correspondence, and any type of pertinent agreements. Next off, entities should send the necessary forms to the proper governmental bodies, commonly consisting of the Department of Education or other designated agencies. It is important to follow target dates, as tardy entries might bring about charges. Additionally, maintaining complete documents of the reporting process is necessary for future audits. Lastly, organizations should train their employees on these treatments to guarantee consistent compliance throughout all departments.

Conformity and Legal Factors To Consider

Just how can companies ensure they fulfill conformity and lawful criteria when recording foreign gifts? To determine directory adherence, establishments have to establish a comprehensive coverage structure that includes clear meanings of foreign presents and thresholds for reporting requirements. Precise documents is necessary, demanding comprehensive documents of the gift's function, source, and worth. Organizations needs to implement inner policies for prompt reporting to appropriate authorities, consisting of government agencies, as specified by the Foreign Gifts and Contracts Disclosure Act. Educating personnel on conformity procedures and preserving open lines of interaction with legal counsel can even more enhance adherence. Routine audits of foreign present documents methods will certainly assist identify potential conformity spaces, assuring organizations maintain lawful requirements while cultivating openness in their monetary connections.

Repercussions of Non-Compliance in Coverage

Failure to abide by international gift coverage requirements can lead to substantial legal charges for institutions. In addition, non-compliance may stain an organization's reputation, undermining count on with stakeholders. Recognizing these consequences is crucial for preserving both lawful and honest requirements.

Lawful Charges for Non-Compliance

Non-compliance in reporting international presents can lead to considerable legal fines that may detrimentally impact establishments and people alike. The Federal government strictly applies laws bordering foreign contributions, and violations can lead to severe effects, including substantial penalties. Organizations may encounter fines getting to countless dollars for each instance of non-compliance, depending upon the quantity of the unreported gift. Additionally, people entailed in the reporting process might encounter personal obligations, including penalties or possible criminal costs for willful neglect. The possibility for audits rises, leading to more analysis of monetary techniques. On the whole, understanding and sticking to reporting requirements is critical to avoid these severe lawful implications and warranty compliance with federal laws.

Impact on Institutional Credibility

While legal charges are a considerable problem, the influence look at this website on an institution's credibility can be similarly profound when it pertains to stopping working to report foreign gifts. Non-compliance can result in public suspect, harmful connections with stakeholders, alumni, and prospective donors. Institutions run the risk of being viewed as unreliable or lacking transparency, which can prevent future financing possibilities. In addition, adverse media coverage may enhance these worries, causing a lasting tarnish on the institution's image. This disintegration of online reputation can have significant consequences, consisting of lowered enrollment, challenges in employment, and deteriorated partnerships with other scholastic or research study organizations. Ultimately, the failure to follow reporting needs not only jeopardizes economic stability yet additionally endangers the stability and trustworthiness of the institution itself.

Ideal Practices for Handling International Presents in Establishments

Properly handling international gifts in establishments needs an organized method that focuses on transparency and conformity. Institutions must establish clear plans outlining the approval, reporting, and utilization of international gifts. A devoted board can supervise these plans, ensuring they line up with both regulatory needs and institutional worths.

Regular training for team involved in present management is important to preserve recognition of compliance responsibilities and moral considerations. Organizations have to perform complete due persistance on prospective foreign contributors to analyze any prospective dangers related to approving their gifts.

Furthermore, open interaction with stakeholders, consisting of faculty and trainees, promotes depend on and minimizes concerns concerning read more foreign impacts. Periodic audits of foreign present deals can assist recognize any disparities and maintain liability. By implementing these finest methods, establishments can efficiently navigate the intricacies of obtaining foreign presents while guarding their stability and online reputation.

Often Asked Concerns

What Types of Foreign Gifts Are Exempt From Reporting?

Can Foreign Gifts Be Used for Individual Expenses?

International presents can not be used for individual costs. They are intended for details functions, commonly related to institutional or instructional support, and mistreating them for personal gain can bring about legal and ethical effects.

Are There Penalties for Late Reporting of Foreign Present?

Yes, fines can be enforced for late reporting of foreign gifts. These might include fines or constraints on future funding. Prompt compliance is crucial to prevent potential lawful and financial consequences associated with such coverage needs.

Exactly How Do International Gifts Impact Tax Obligation Responsibilities?

International gifts might influence tax responsibilities by possibly going through reporting needs and, sometimes, tax. Receivers should divulge these presents to guarantee compliance with internal revenue service regulations and prevent fines or unexpected tax obligations.

Can Establishments Refuse International Presents Without Coverage?

Establishments can reject international presents without reporting them, as there is no responsibility to approve contributions. report a foreign gift. If accepted, they should stick to regulative demands pertaining to disclosure and possible effects on tax obligation commitments.